PROJECTS

Project Overview

Conrad, via its wholly owned subsidiaries, is the holder of two operated tenements in offshore Indonesia in the form of Production Sharing Contracts (PSCs):

- Duyung PSC (76.5% interest)

- 2C Contingent Resources of 413 Bcf (215 Bcf net to Conrad)1

- Mako is the largest undeveloped and fully appraised gas field in West Natuna Basin

- Offshore North West Aceh and Offshore South West Aceh (100% each)

- Four gas discoveries with 2C Contingent Resource of 214 Bcf (161 Bcf net to Conrad)

- NPV of existing gas discoveries US$88m net to Conrad

- A combined Prospective Resources in excess of 15 trillion cubic feet (“Tcf”) of recoverable gas of which around 11 Tcf (P50) are net attributable to Conrad2.

- Covering approximately 22,000km2 in shallow and deep water areas with numerous gas discoveries flow tested in the shallow water areas

1) Competent Person’s Report (CPR) for Duyung by Gaffney, Cline & Associates (GaffneyCline) 26 August 2022 as outlined in the Company’s IPO prospectus dated 9 September 2022.

(2) ASX Release: Aceh: Prospective Resources in Excess of 11 Tcf (Net) - 16 November, 2023

Attractive Portfolio of Projects

Duyung PSC (which contains Mako) is the cornerstone asset of Conrad’s

portfolio with additional exploration assets providing upside

(1) Competent Person’s Report (CPR) for Duyung by Gaffney, Cline & Associates (GaffneyCline) 26 August 2022. Resources attributable to Conrad are based on Conrad's participating interest of 76.5% in the Duyung PSC.

(2) ASX Release - 13 November 2023: Aceh: Prospective Resources in Excess of 11 Tcf (Net)

(3) The timing and process for any tender/bidding process is within the discretion of, and managed by, MEMR.

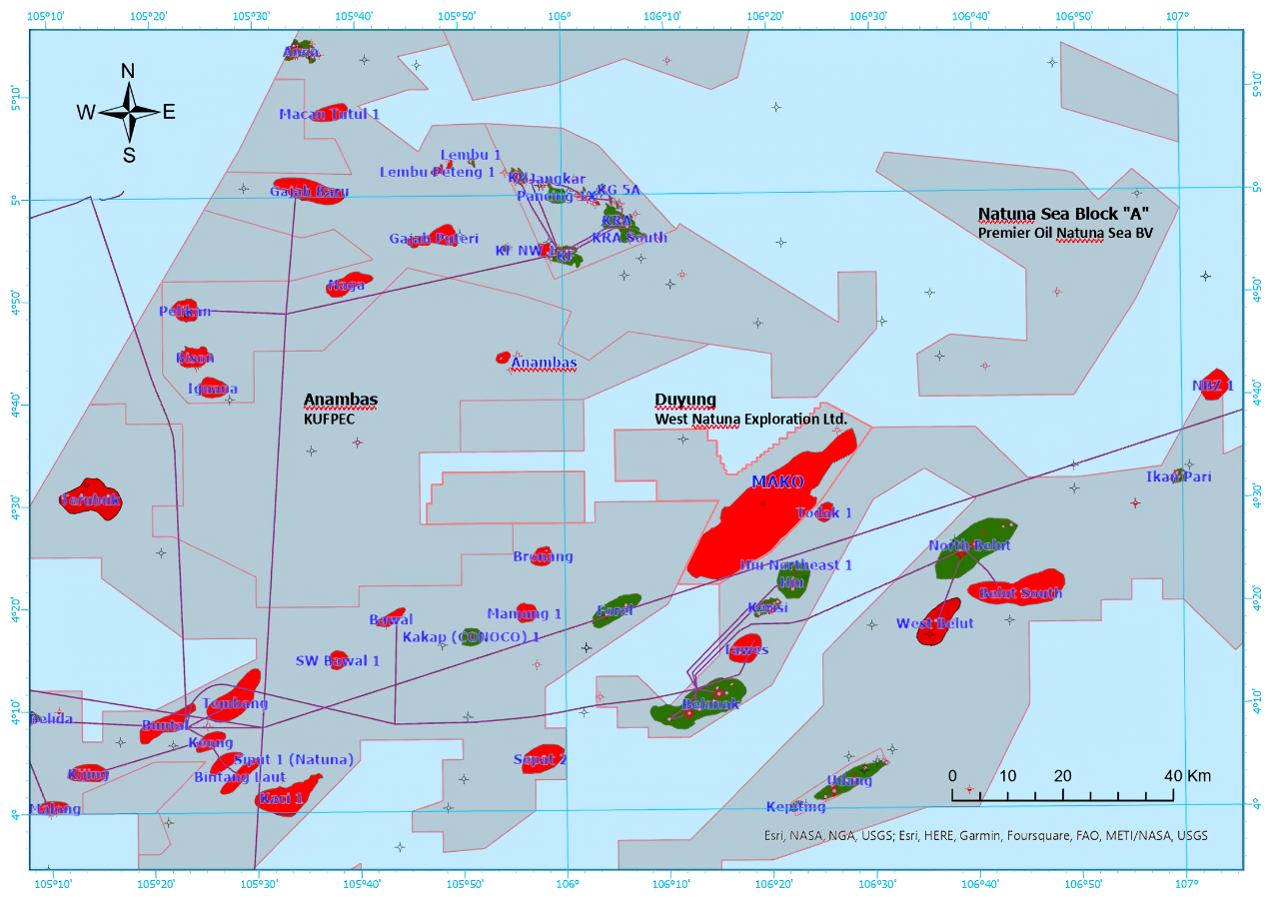

Duyung PSC and Mako Gas Field

Largest Undeveloped Gas Discoveries in the West Natuna Sea with Key Under-Utilised Infrastructure in Place

Project Overview

- The Mako Gas Field principally lies within the Duyung PSC in the Natuna Sea which is recognised a major hydrocarbon basin

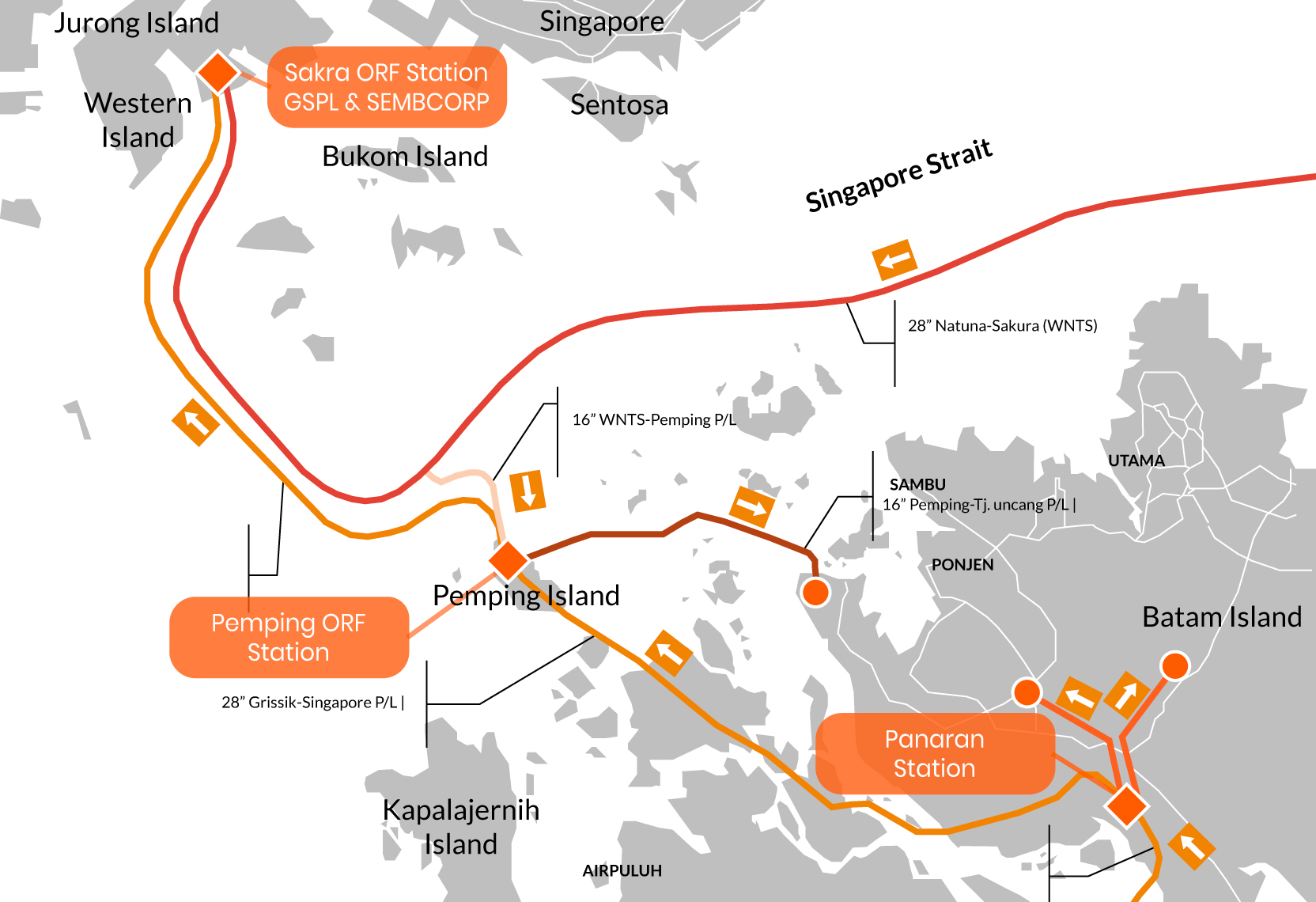

- The West Natuna Sea has been supplying gas to Singapore and Malaysia for decades with established infrastructure connected to major markets

- Mako is one of the largest undeveloped gas resources in the area and is expected to become an important strategic supplier of gas to Singapore

- Mako Gas Field has been assessed to contain gas comprising 98% methane gas with insignificant impurities and a high permeability reservoir with excellent productive capability1

- The Indonesian Regulator, SKK Migas, approved a revised POD in October 2022 with sales gas rates of up to 111 bbtu/d2 . The current Mako CPR2 contemplates the production of 2C Resources from Mako of 413 Bcf (215 Bcf net to Conrad)3 *

- Key Terms for a Gas Sales Agreement ("GSA") were agreed in September 2023 between Conrad, Sembcorp Gas Pte Ltd and SKK Migas. Parties are now targeting the execution of a formal GSA as soon as practicable, prior to the end of Q2 2024

(1) Competent Person’s Report (CPR) for Duyung by Gaffney, Cline & Associates (GaffneyCline), 26 August 2022.

(2) POD 1 Revision. The implementation of a POD must be progressed within 5 years of the approval of the POD by MEMR, otherwise the PSC will be automatically terminated.

(3) ASX Release - Aceh: Prospective Resources in Excess of 11 Tcf (Net), 13 November 2023

* Mako Contingent Resource estimates will be reviewed in light of finalisation of the GSA and post-tender cost update

Mako Gas Field in the West Natuna Sea

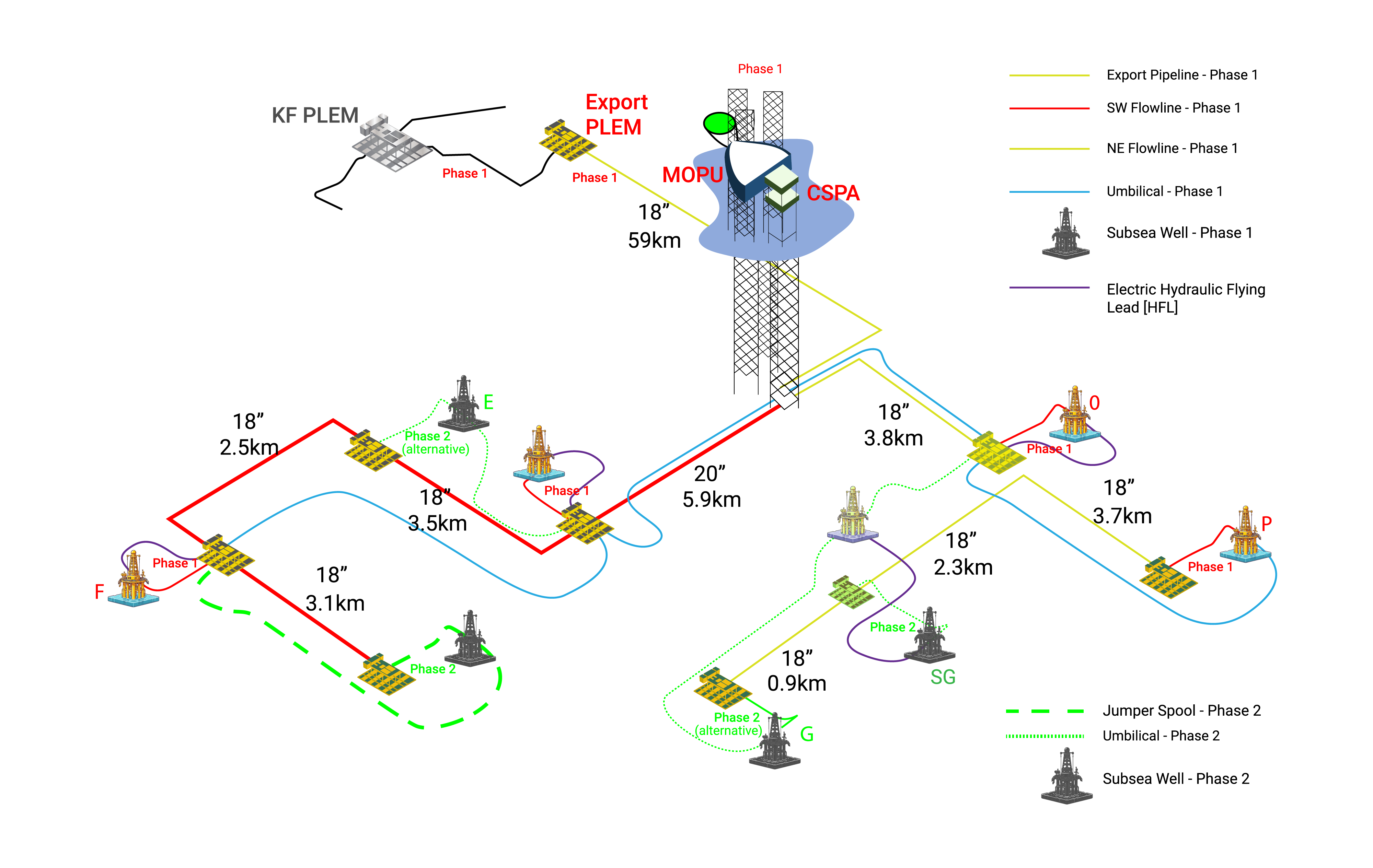

Mako Development Key Facts

Water Depth

c 90 m

Gas Water Contact

1287 ft TVD SS

Facility

Leased MOPU with gas processing & compression

Wells

6 wells - Phase 1

2 wells - Phase 2

Plateau

111 bbtu/d (sales gas)

Gas Export

Export line to Kakap field PLEM thence via West Natuna Transportation System

Mako Gas Field Phase 1 and 2 development

Mako is Strategically Positioned to Supply Established Gas Markets

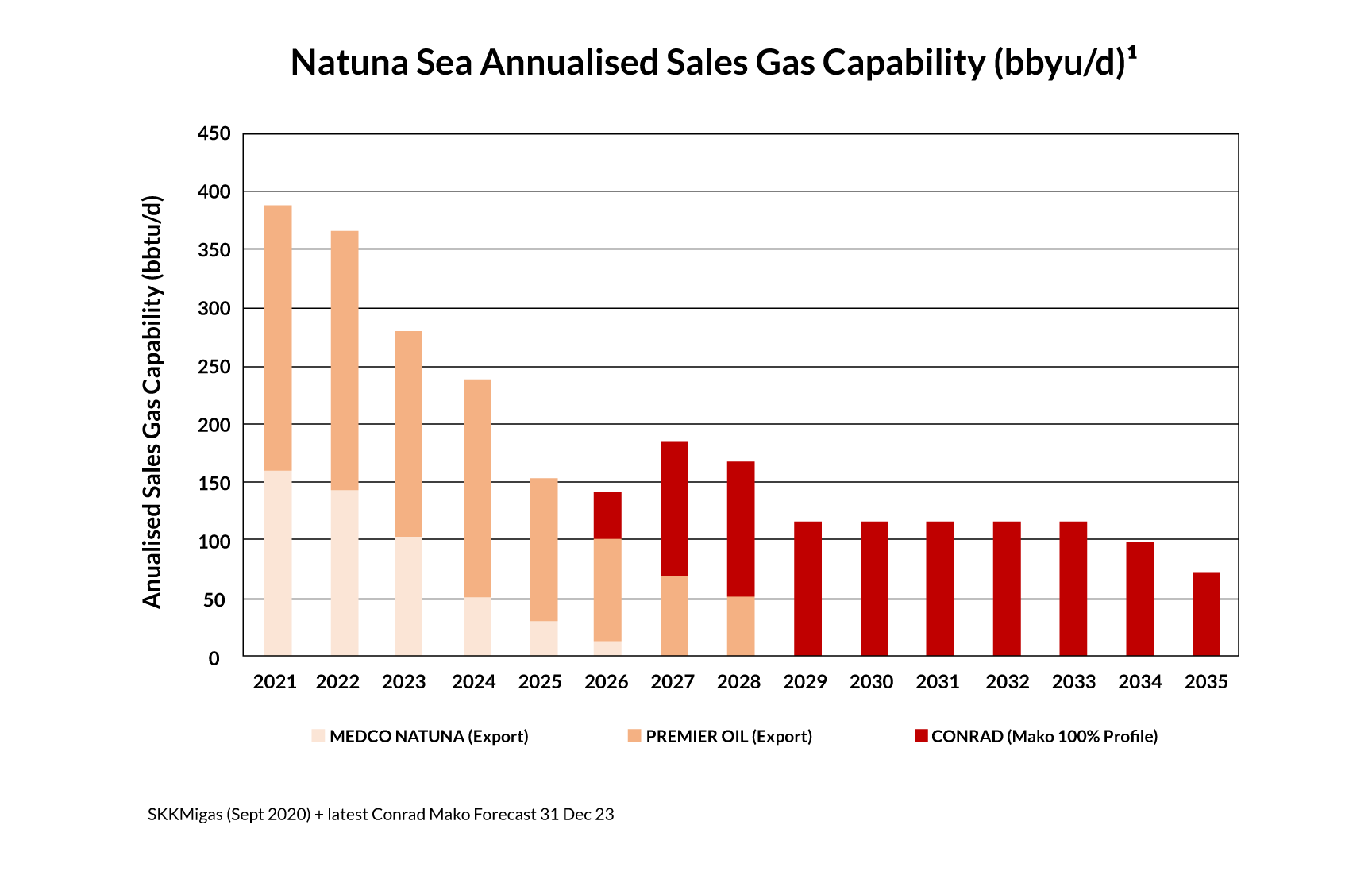

Mako adjoins major gas export infrastructure (WNTS) with currently only ~60% (and steadily declining) utilisation rate

Mature Export Gas Sales Agreement to Supply Asian Demand

Conrad Asia Energy has signed a non-binding Term Sheet with Sembcorp Gas Pte Ltd. (a Singapore based major gas and generating utility) which outlines the core terms and framework as the basis for negotiating a final binding Gas Sales Agreement (GSA)4.

- Gas sales for export to Singapore will be priced against Brent oil

- The parties to the Term Sheet have agreed to negotiate, in good faith, a definitive Gas Sales Agreement within Q2 2024

- The key terms of the Term Sheet relate to the sale of Mako gas from start of production to the end of the Duyung PSC in 2037, for a total sales gas volume up to the entire Mako production from a minimum of 67% of Mako gas production while the remaining portion of the Mako gas would be sold to the domestic market

Conrad is subject to a domestic market obligation (DMO) requirement set out under the PSC, requiring supply of 29.5% of the Mako gas to the domestic market.

- The domestic gas price is $5.5 per mmbtu

- Delivery of Mako Gas Field gas to Indonesia requires the domestic buyer to build a spurline to the Pemping station, estimated at US$100m

- In the absence of a GSA with a domestic buyer, the domestic portion of the Mako gas production is to be exported4

(4) ASX Release - Ministerial Approval of Mako Gas Price & Allocation, 26 February, 2024

Singapore Gas demand

In 2021, Singapore consumed 13.4 Bcm (~1.29 Bcf per day) of natural gas, all of which was imported from mostly Indonesia, Malaysia and as LNG. Since 2000, Singapore has shifted away from less efficient fossil fuels and increased the percentage of natural gas used in electricity generation from 19% to more than 95% today5, and Singapore is a LNG trading hub ensuring a strong market mechanism.

In Singapore natural gas provides 95% of Singapore’s electricity generation needs, and they are four gas-turbine combined cycle power generation units to be built by 2026:

- Sembcorp - 800 MW of power and 400 tonnes per hour of process steam., requiring approximately 115 Bbtud of natural gas

- Keppel - 600MW Cogen Plant to initially run on natural gas but can transition to running fully on hydrogen.

- Meranti Power - Two 340 MW Open Cycle Gas Turbine (OCGT) units to be operational by 2025 and intended to balance the market as the 30+ year Open Cycle GTs are retired

Pipeline gas remains an important source of supply to Singapore as it seeks to transition its energy grid and realise lower carbon-emissions/unit-volume delivered than from LNG. As Singapore starts to shift its energy-generation mix, gas will dramatically increase by comparison to other sources.

ACEH PSCs

Project Overview

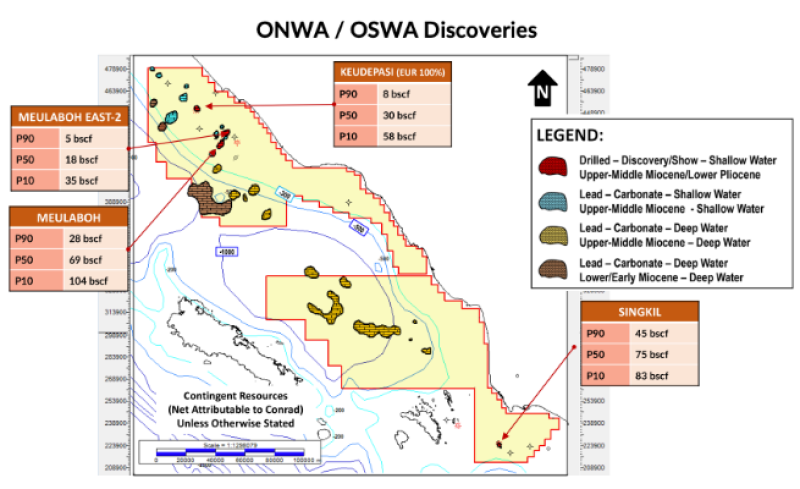

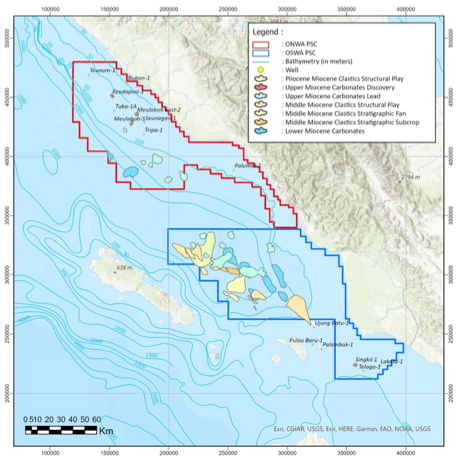

The Aceh PSCs (Offshore North West Aceh (Meulaboh) (ONWA) and Offshore South West Aceh (Singkil) (OSWA)) contain numerous offshore gas discoveries as well as large exploration opportunities.

- A combined Prospective Resources in excess of 15 trillion cubic feet (“Tcf”) of recoverable gas of which c 11 Tcf (P50) are net attributable to Conrad1.

- Competent persons reports estimate a gross 2C Contingent Resource of 214 Bcf of sales gas2

- 161 Bcf net attributable to Conrad

- Estimate NPV of US$88m net attributable to Conrad

- Conrad entered into a Memorandum of Understanding (MOU) with PT Perusahaan Gas Negara, the gas subsidiary of Indonesia’s national oil company PT Pertamina3.

- MoU is for the provision of gas or LNG supply and development infrastructure for gas resources from its two offshore Aceh PSCs

- MOU is an important step towards the commercialisation of the discovered resources that might be a key component of any future Plans of Development

- The Aceh PSCs cover a combined working area of approximately 22,000km2 with each area containing gas discoveries.

- Conrad is operator of both PSCs with a 100% interest in each and 30-year tenure.

- Water depths vary between 5-1,500m with the existing discoveries located in shallow water depths of 50-80m, respectively.

- Both PSCs contain flow-tested gas discoveries in shallow water

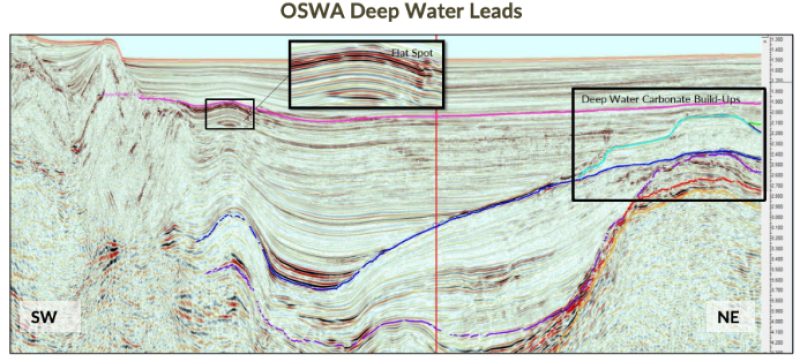

- Available seismic data reveals that both PSCs contain structures that suggest multi Tcf gas prospectivity (with gas chimneys and flat spots displayed on seismic data) in the deeper water areas of the blocks

- Conrad plans to acquire 3D seismic over the cluster of discovered resources in ONWA, which currently only has sparse 2D seismic acquired in the 1970s, in order to better define the resource size

(1) ASX Release: Aceh: Prospective Resources in Excess of 11 Tcf (Net) - 16 November, 2023

(2) ASX Release: Supplement to Increase in Total Net Attributable Resources - 8 May 2023

(3) ASX Release: Aceh Gas Commercialisation MOU Signed with PGN - 3 March 2024

Offshore Aceh History and Development

- Competent Persons Reports recently completed and have estimated a gross (100%) 2C Contingent Resource of 214 billion cubic feet (“Bcf”) of sales gas (161 Bcf net attributable to Conrad) in three discovered gas accumulations in the two PSCs.

- The shallow water discoveries, located close to shore, were made in the 1970’s and are sited in geological formations known as “pinnacle reefs”.

- The gas flowed to surface from all of the discoveries is predominantly methane gas (CH4).

- The shallow water areas of ONWA and OSWA have had a historically high exploration success rate of over 30% in both PSCs, however in the wells which targeted the main prospective horizon, Upper Miocene Carbonate reefs, the success rate has been over 66% based on 1970’s seismic data

- Modern 3D seismic should help elucidate other shallow water gas targets over this vast area

- These shallow water discoveries prove the hydrocarbon potential of the area and upgrade the larger deep water targets