PROJECTS

Project Overview

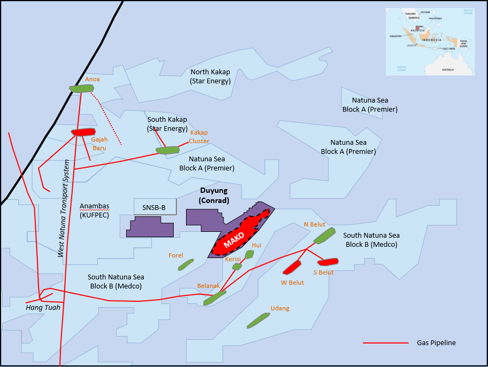

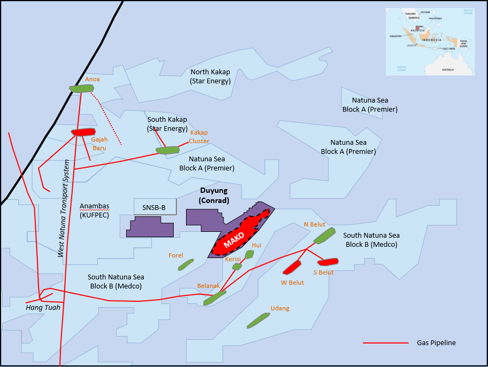

Conrad, via its wholly owned subsidiaries, is the holder of three operated tenements in offshore Indonesia in the form of Production Sharing Contracts (PSCs):

- Duyung PSC (76.5% interest);

- Offshore Mangkalihat PSC (100% interest); and

Conrad has also completed joint studies in two areas - being Offshore North West Aceh and Offshore South West Aceh (together, the JSAs (Joint Study Areas)) in the offshore Aceh Province in Indonesia, and will have the right to match in the bidding process for both areas when they are gazetted as PSCs in a future licencing round.

Attractive Portfolio of Projects

Duyung PSC (which contains Mako) is the cornerstone asset of Conrad’s

portfolio with additional exploration assets providing upside

(1) Competent Person’s Report (CPR) for Duyung by Gaffney, Cline & Associates (GaffneyCline) 26 August 2022. Resources attributable to Conrad are based on Conrad's participating interest of 76.5% in the Duyung PSC.

(2) ASX Release - 13 November 2023: Aceh: Prospective Resources in Excess of 11 Tcf (Net)

(3) The timing and process for any tender/bidding process is within the discretion of, and managed by, MEMR.

Duyung PSC and Mako Gas Field Overview

One of the largest undeveloped gas discoveries in the West Natuna Sea with key under-utilised infrastructure in place

- Mako Gas Field is one continuous “single tank” of methane gas with insignificant impurities and a high permeability reservoir with excellent productive capability

- POD for Mako Gas Field approved in February 2019, converting PSC from exploration to exploitation, and extending tenure to 2037

- Following successful drilling campaigns, Conrad worked with SKK Migas on a revised POD1 that is currently being approved by the Indonesian regulator. The current Mako CPR2 contemplates the production of 2C Resources from Mako of ~413 Bcf (gross),

- Ongoing discussions with buyers in Singapore and Indonesia on gas sales agreements. Two Heads of Agreement already signed with Singapore buyers

- Mako holds high quality gas (98% methane, no mercury, no heavy metals), requires no LNG refrigeration emissions / energy consumption has no requirement for regasification and has a lower carbon footprint2

- Will shortly commence FEED work for the development of the field from funds raised under the proposed IPO

(1) The implementation of a POD must be progressed within 5 years of the approval of the POD by MEMR, otherwise the PSC will be automatically terminated.

(2) Competent Person’s Report (CPR) for Duyung by Gaffney, Cline & Associates (GaffneyCline) 26 August 2022.